Investments

Investment Return

Each year, once the Scheme’s financial statements have been audited and the tax calculations completed, the Trustees declare a rate of return to be applied to your accounts in the Scheme. The same rate applies to all members and to all their accounts. The rate of return depends on the investment return on the Scheme’s assets, less taxes and certain expenses –this year 3.38%.

Each year the Trustees consider the appropriate level of the Reserve Account. For the year ended 31 March 2025, the Trustees agreed that the Reserve Account should be maintained at 0.5% of the total net assets, in line with the Trustees’ policy.

Based on the March 2025 interim rate of -1.44% (negative), the Reserve Account would be lower than the required 0.5% level; accordingly the March 2025 interest rate was adjusted down to the final March 2025 rate of -1.64% (negative) on 30 May 2025.

The Reserve Account builds up each year when members leave the Scheme and are not entitled to the full balances in their Employer Subsidy Accounts. As well as differences between actual and expected expenses, insurance costs and estimated interest applied for exiting members.

This year, your accounts have been updated with an investment return of 3.17%. The interim rates applied during the year are shown on page 7.

The following chart shows the investment returns credited to members’ account balances for the past decade. Although the Scheme has had its annual ups and downs, reflecting the conditions of the markets in which assets are invested, it has paid members an average return of 3.88% p.a. (after tax and expenses) over the last 10 years.

If you leave the Scheme during the year, an interim interest rate will be applied to your accounts. The interim rates applied during the year are shown on page 7.

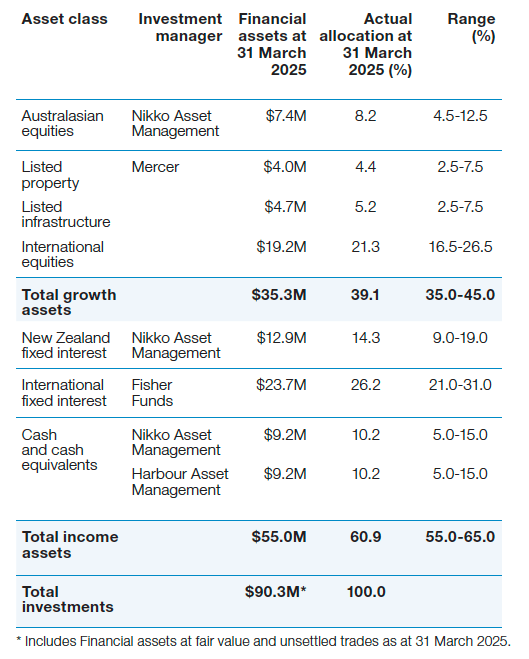

The Scheme's Investment Managers

The Scheme’s assets are currently invested in a mix of equities, real assets (property and infrastructure), fixed interest, cash and cash equivalents. The Trustees have adopted a sector specialisation approach, which involves identifying and selecting separate managers for each asset class.

These managers are chosen because of their expertise in that asset class and are therefore expected to add value in each individual asset sector. The Scheme’s investment managers as at 31 March 2025 are shown in the investments table shown on page 4.

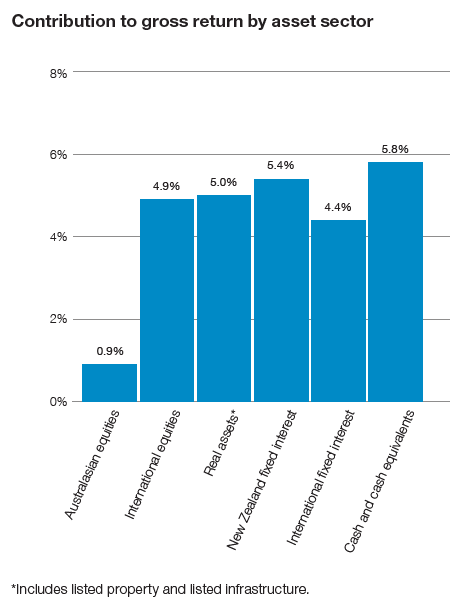

The Scheme’s assets earned 4.88% before tax and fees for the year ended 31 March 2025. The contribution towards this return from each asset sector is shown in the graph below.

The percentages are before the deduction of tax, investment management fees and expenses.

Investment Objectives

The Scheme’s long-term investment objectives are:

over rolling 10-year periods, to achieve a return after tax and investment fees that exceeds inflation by 1.25% p.a.

over a rolling three-year period, to achieve a Scheme return (gross of tax and investment fees) that exceeds the Composite Benchmark Return by 1.0% p.a.

over a rolling three-year period, to achieve a return (gross of tax and investment fees) in each asset class that exceeds the relevant benchmark index return.

Investment Strategy

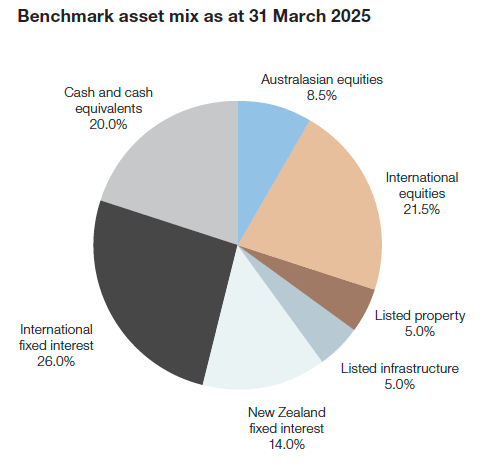

The Trustees set an investment strategy and determine a long-term asset mix to enable them to achieve their objectives. This asset mix is known as a ‘benchmark’ and allows the assets to be spread across various asset classes.

Investments as at 31 March 2025

The investment managers’ performance is monitored by the Trustees, taking into consideration advice from the investment consultant.

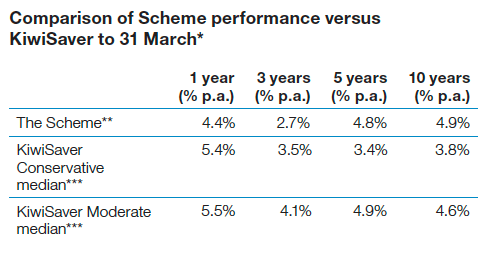

* This table compares MISS Scheme returns against all funds in the Conservative and Moderate sub-universes of the MJW KiwiSaver Survey as at 31 March 2025. This Survey includes Conservative Funds from 16 KiwiSaver Schemes and Moderate Funds from 11 KiwiSaver Schemes. Not all KiwiSaver Schemes are included in the MJW KiwiSaver Survey. The MISS Scheme has a strategic asset allocation to growth assets of 40% compared to the Conservative and Moderate sub-universes of the MJW KiwiSaver Survey which include funds with allocations to growth assets of 15-29% and 30-49% respectively. The Moderate sub-universe does not include KiwiSaver Default Funds, which have their own sub-universe with a strategic asset allocation to growth assets between 50-60%.

** These returns are before expenses and tax, but after investment management fees and do not reflect the actual final credited rate

*** The KiwiSaver median returns are before expenses and tax and after investment management fees.